For investors

Archangels benefits from having a relatively small but active and engaged network.

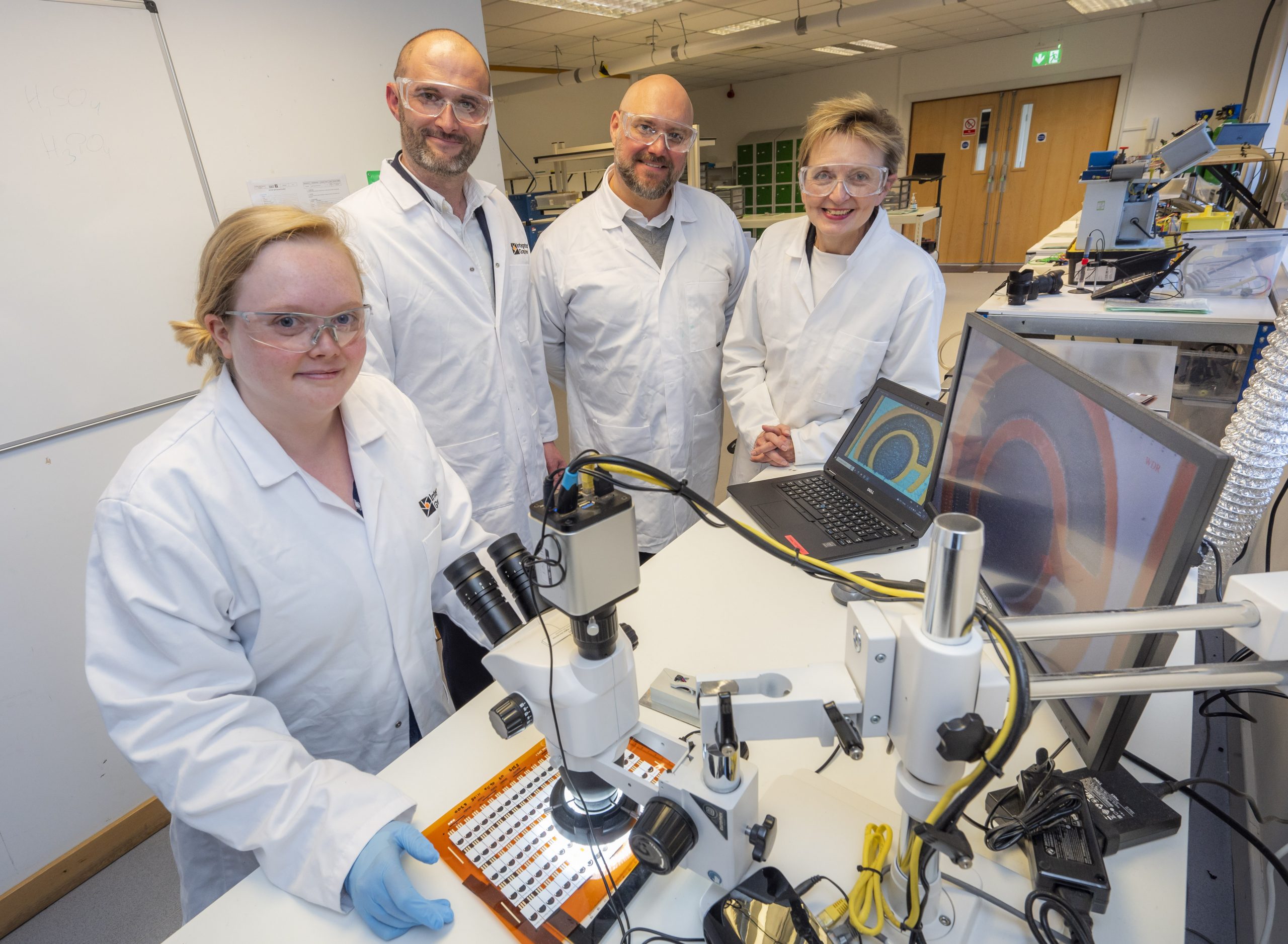

Our members invest in promising start-up and early-stage companies from Scotland’s vibrant technology and life sciences sector.

Investment approach

Our members share a common approach to angel investing:

Portfolio Approach

They choose which of our companies they invest in and they recognise the benefits of a portfolio approach to investment, in terms of balancing and mitigating risk.

Common Objective

Their objective is to build businesses of scale, based in Scotland.

Offer Support

They support our companies by offering their expertise and access to their network but they don’t get actively involved in the running or governance of our companies (unless they are sector specialists, in which case it may be appropriate for them to be involved).

Trust in Archangels

They trust our office and independent investor directors, to ensure that our companies are on the right track, but they are keenly interested in our companies.

Patient Investors

They understand that investing in an early-stage company can be a long journey and that patience and the ability to offer continued financial support is fundamental. On average, the period from initial investment to exit is over eight years and can typically involve five or six funding rounds.

Give Something Back

They have a desire to give something back and develop the next generation of entrepreneurs in Scotland.

Tax advantages

Unless otherwise stated, all financial investments are made under the terms of the Enterprise Investment Scheme (EIS) which provides significant tax advantages to investors.

The tax benefits of EIS under current legislation are:

Income tax relief at 30%

No capital gains tax on gains made by the syndicate

Full inheritance tax relief

(after two years)

Capital gains tax deferral relief

Loss relief up to 45% of net investment after income tax relief of 30%, representing total tax reliefs of 61.5% of the original investment.

Losses of individual investments are not netted against gains in the portfolio

ESG STATEMENT

Environmental, Social and Governance (ESG) considerations are an important part of our investment process, corporate framework and culture and we believe the continuous assessment of ESG risk is intrinsically linked to our own vision, mission, and values.

Relevant issues pertaining to ESG are discussed regularly by the investment team and are raised, as required, at New Deals Committee, Audit and Risk Committee and the Archangels Board.

Our investment team will consider, evaluate and document ESG as part of our due diligence process and will seek to embed an ESG mindset within our investee companies.

Given the stage at which we invest, we do not expect our portfolio companies to have a fully- developed ESG strategy in place at the point of investment. Instead, we look for good corporate behaviours and over the life of our investment we expect this to mature into comprehensive ESG actions and reporting procedures.

Archangels is a leading early-stage investor whose vision is to deliver outstanding financial returns to our members, whilst managing and mitigating risk and, where possible, making a positive social and environmental impact.

- responsible waste management procedures

- building out an environmentally friendly supply chain where commercially practicable

- limiting the pollution of greenhouse gases, wherever possible, and

- managing and using resources efficiently, such as energy, land, water and raw materials

- creating a positive and inclusive working environment

- ensuring adherence to laws and regulations regarding employee working conditions such as fair wages, working hours and the health and safety of the employees.

- Building an environment of trust and transparency across all aspects of the business

Membership benefits

Archangels office access

Access to the Archangels’ office to source and manage your direct investments. As the longest continuously operating syndicate in the world, we understand early stage investing and have an excellent track record

Careful diligence

Knowledge that all funding propositions have been carefully due diligenced by our Executive Team for several months and have the support of our Board

Participate in all new investment opportunities

The right to participate in all new investment opportunities on the same basis as all other members

Participate in follow on funding rounds

Opportunity to participate in follow on funding rounds for all portfolio companies, subject to pre-emption rights and any scaling back required. See our policy on scaling back in our Member Handbook

Investor portal

Access to our online investor portal, which details all current and historic Archangels’ investments, giving you a full statement of your Archangels investment portfolio at any time

Appointed Archangels observer

An Archangels observer appointed to all portfolio companies from our Executive Team, who attends company Board meetings and is responsible for monitoring, supporting and where appropriate, intervening

Performance updated

Regular updates from the Archangels’ office on portfolio company performance

Archangels' events

Invitation to Archangels’ events throughout the year, including Chorus (our annual portfolio company tradeshow and dinner) and AGM.

New Deals Committee meetings

Members are also welcome to attend our New Deals Committee meetings, where our team discuss current opportunities they’re reviewing and an Archangels Board meeting and lunch.

Engage with like-minded people

The opportunity to engage with a group of like-minded people, who are collectively motivated by giving something back and making a real economic impact in Scotland.

We charge members an annual fee of £2,000 plus VAT, to cover some of the cost of running the office.

Member events

Latest news

About Archangels

Based in Edinburgh, Archangels is a prominent business angel syndicate which has been at the forefront of early stage investing in Scotland for more than a quarter of a century.

Our portfolio

We focus on IP rich technology and life-sciences companies, and have invested in sectors ranging from software development and photonics to medical devices and bionics.